foreign gift tax india

Short title extent application and commencement. A person resident in India can open a foreign currency account in India with an authorised dealer.

India S Second Moon Mission Will Target Its South Pole Credits Toi General Knowledge Facts Moon Missions Gernal Knowledge

So if you are thinking of transferring funds from overseas to your parents or close relatives for their personal expenses you should just directly.

. CONVERT FIGURES IN TO WORD EXCEL ADD IN INDIAN RUPEE. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. 1 FEM Foreign Currency Accounts by a person Resident in India Regulations 2000 was repealed and replaced by FEM Foreign Currency Accounts by a person Resident in India Regulations 2015 with effect from January 21 2016.

Income Tax Department Tax Laws Rules Acts Foreign Contribution Regulation Act 2010 Choose Acts. The Salt March also known as the Salt Satyagraha Dandi March and the Dandi Satyagraha was an act of nonviolent civil disobedience in colonial India led by Mahatma GandhiThe twenty-four day march lasted from 12 March 1930 to 6 April 1930 as a direct action campaign of tax resistance and nonviolent protest against the British salt monopolyAnother reason for this. Foreign income war profits and excess profits taxes are the only taxes that are eligible for the credit.

The income taxed by this act can be generated from any source such as profits received from salaries and investments owning a property or a house a business etc. Income Tax in India is governed by the rules set by this act. Regardless of how high the energy price.

Types of direct taxes in India. The income rule for providing relief to taxpayers claiming foreign tax credit FTC has been amended. The reform of Indias indirect tax regime was started in 1986 by Vishwanath Pratap Singh Finance Minister in Rajiv Gandhis government with the introduction of the Modified Value Added Tax MODVAT.

56 Records Page 1 of 6 Section - 1. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Taxpayers generally US persons and foreign persons with effectively connected US trade or business income may claim a credit against US federal income tax liability for certain taxes paid to foreign countries and US possessions.

Lets take a look at what you can expect as income taxes in India when you send money home. For the purpose of the Income Tax Act a person. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. In economics a gift tax is the tax on money or property that one living person or corporate entity gives to another. The Foreign Exchange Management Foreign currency accounts by a person resident in India Regulations 2015 regulates the foreign currency accounts opened in India.

The entire global income of a tax resident of India is taxable in India irrespective of source said Archit Gupta founder and CEO Clear. 2 FEM Deposit Regulations 2000 was repealed and replaced by FEM Deposit Regulations 2016 with effect from April 1 2016. Skip to main content.

Article 21 of the India USA Tax treaty stipulates that students or business apprentice who are residents or Citizens of India and are present In the USA principally for the purpose of their education or training shall be exempt from tax in the US from payments which arise outside the USA for purposes of their maintenance education or training. UNDISCLOSED FOREIGN INCOME AND ASSETS AND IMPOSITION OF TAX ACT 2015. In a full year the maximum amount of tax the next leader would have to pay in return for receiving free gas and electricity is around 3400 each year.

Gift Tax on Movable property in India without consideration If aggregate fair market value of movable properties such as shares and securities jewellery archaeological collections drawings paintings or any work of art received without consideration during a previous year exceeds Rs. Pakistan has executed tax treaties with more than 66 countries see the Withholding taxes section in the Corporate tax summary for a list of countries with which Pakistan has a tax treaty. This is aimed at promoting the growth of global trade with.

Short title extent and commencement. Just to be clear it is always best to consult a tax attorney for your personal taxes in your current country and in India. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

The only tax youd be required to pay is the service tax negligible amount and the transaction charges when you transfer money to India using any foreign exchange or money transfer services. 50000- the whole of aggregate fair market value of. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

To stay updated. Ministry of Finance Government of India. Ask 1800 180 1961 1961 Income Tax Department.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. DOWNLOAD 891 RELIEF CALCULATOR FREE FY 2021-22 AY 2022-23. Income Tax India.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Income Tax Act is also called the IT Act 1961. The transfer must be gratuitous or the receiving party must pay a lesser amount than the items full value to be considered a gift.

83 Records Page 1 of 9 Section - 1. To stay updated. Qualification Disqualification of Auditors under Companies Act 2013.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. 0 1 0 3 0 5 5 1 7 4. Rental price 70 per night.

Subsequently Prime Minister P V Narasimha Rao and his Finance Minister Manmohan Singh initiated early discussions on a Value Added Tax VAT at the state. Income Tax Department Tax Laws Rules Acts Gift-Tax Act 1958 Choose Acts. The Income Tax Department NEVER asks for your PIN numbers.

Income Tax India. The Central Board of Direct Taxes CBDT has made changes to rule 128 under Income Tax Rules. Section - 2.

The points outlined below are not to be taken as tax advice but rather a quick and broad look at gift taxes in India. These conventions aim to eliminate double taxation of income or gains arising in one territory and paid to residents of another territory. The Reserve Bank of India on Monday allowed invoicing and payments for international trade in rupees potentially facilitating greater bilateral business with Russia that is facing a wide range of Western sanctions and is virtually cut off from standard cross-border payment platforms.

Cleartax S Infographic Of What Incomes And Losses The Different Itr Forms Include And Exclude Residual Income Business Income Tax Return Website Income

Blog Buying Property In London There May Be Tax Implications London Property Buying Property State Art

What Are Tax Rules For Foreign Retirement Accounts Mint

Home Legal Services Legal Advice Legal

Valentine Plan Gift For Your Life Partner Gift Your Life Partner A Gift On Every Valentine S Day For Life Valentines Plans Life Partners Financial Planner

Cbdt Releases Faqs On Itr Filing To Assist Taxpayers Sag Infotech Income Tax Return Income Tax Return Filing Tax Return

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Tax On Gifts In India Fy 2019 20 Limits Exemptions And Rules

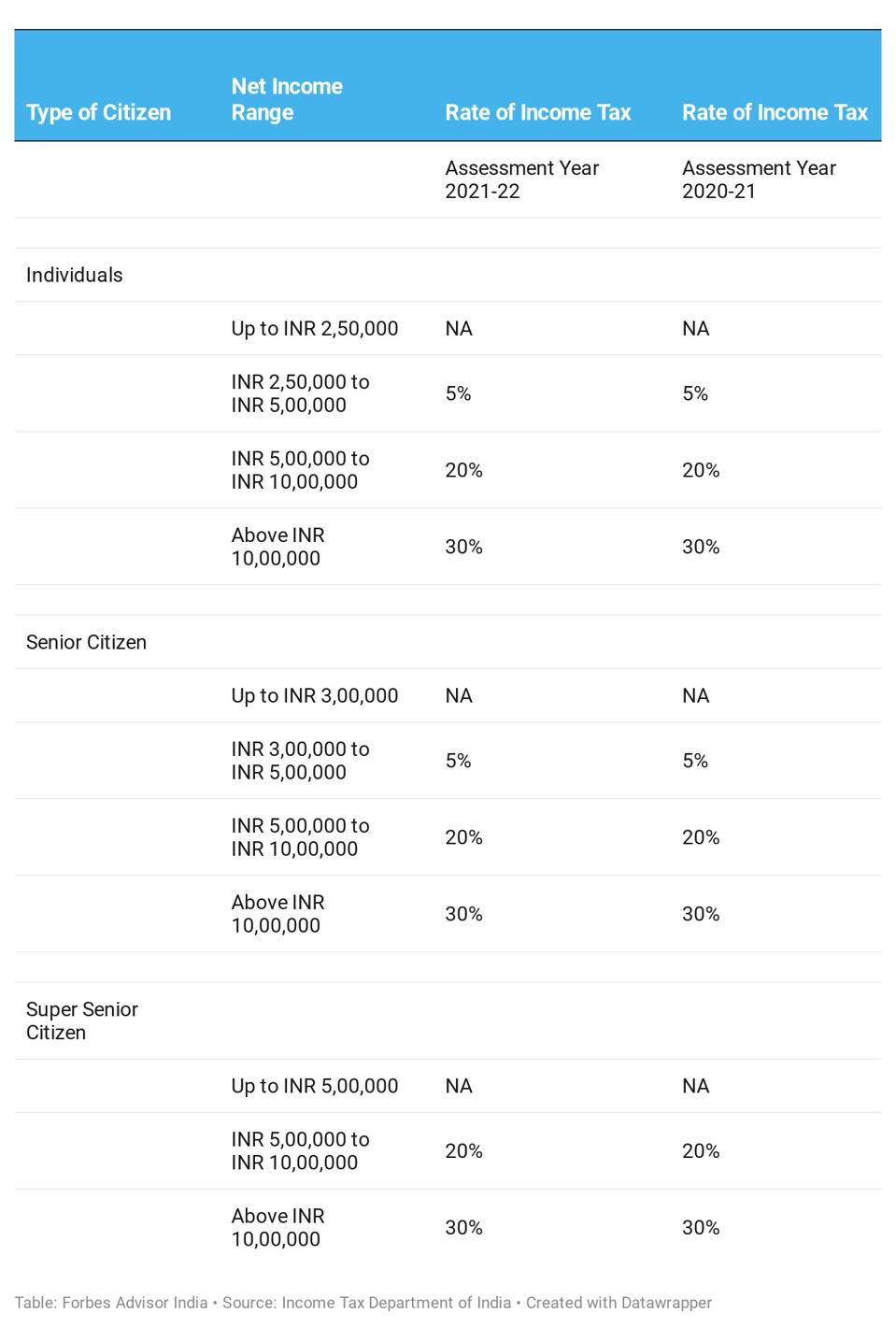

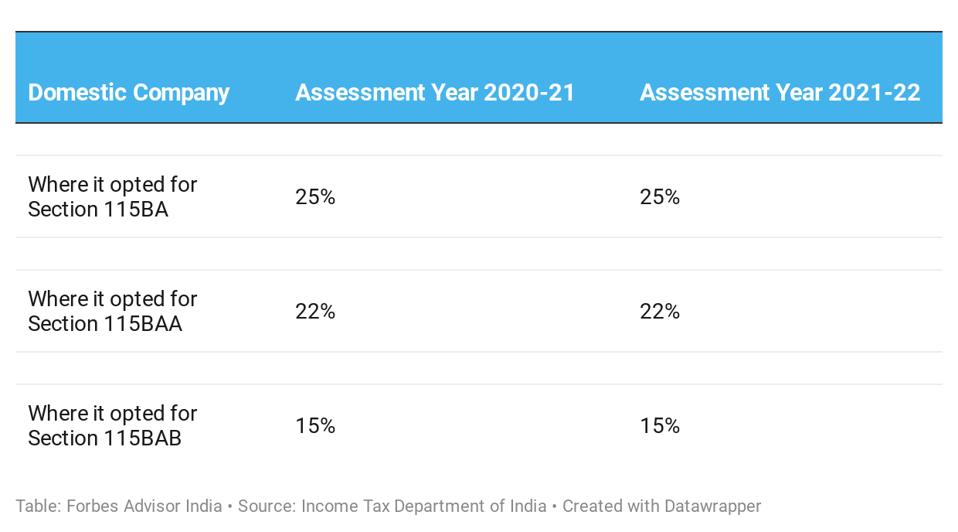

Know Types Of Direct Tax And Charges Forbes Advisor India

Yes Reserve Bank Has Granted General Permission To Foreign Citizens Of Indian Origin To Acquire Or Dispose Of Properties Up To The Originals Citizen Ahmedabad

Circular Flow Of Income In Four Sector Economy Circular Flow Of Income Income Goods And Services

Best Time To Send Money To India From Usa Send Money Money Forex

Kvic Bags Order From Iiit Allahabad Khadi Small And Medium Enterprises Design

Know Types Of Direct Tax And Charges Forbes Advisor India

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri